Mariann Montagne, CFA

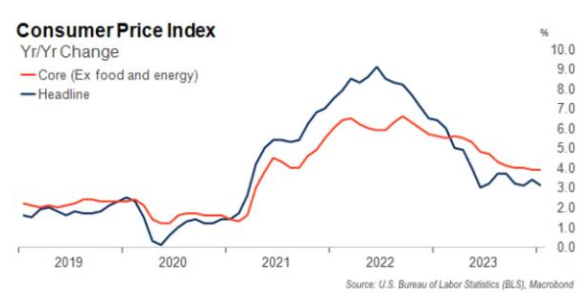

Summary: While the government inflation rate moves toward the Fed’s 2% goal at a snail’s pace, higher interest rates are likely to mean lower valuations for bonds as well as stocks. Higher rates will also stem borrowing for business expansion and mortgages which in turn could cause home prices to fall.

The inflation report for January was higher than the consensus estimates, which in turn has caused interest rates to head higher.

Anyone with a budget (teenager thru retiree) would tell you that since COVID, prices for most everything have only gone up. We have seen no overall retreat in prices of goods as the textbook supply/demand curve would dictate – despite widespread increases in supplies for the last year or two. Services are seeing a reacceleration in prices. This is a popular topic in the media and in living room conversations.

Looking at the last few months, from a low of 0.1% in October, the consumer price index accelerated to 0.2% in both November and December and has accelerated again to 0.3% for January on a month-over-month basis. On an annualized basis, last month’s inflation equates to 3.6%.

The Federal Reserve Board has stated repeatedly that they require inflation to fall to 2.0% before they can reverse course and cut interest rates. Today’s report is causing interest rates in the market to accelerate, particularly for two-year Treasuries, as many believed lower inflation would lead to multiple interest rate cuts by the Federal Reserve beginning in the first half of 2024. Such cuts now may be off the table.

If we look at the primary component of January’s inflation gain, as broken down by the US Bureau of Labor Statistic’s Consumer Price Index report, we see that shelter is the chief culprit. The government calculates the housing portion of the shelter index by estimating how much it would cost homeowners to rent their house if they rented it.

Most people in finance find that an interesting quest. Kind of like calculating what it would cost me to own a dog if I had a dog (which I don’t).

The shelter index rose 0.6% last month or 6.0% on a year-over-year basis. The rent portion of the shelter index rose 0.4% last month. We find that odd since most rents have flattened out or actually started to decline. But the government uses data from prior months to “smooth” their rent index, hence the disconnect from current rates. This month’s data won’t show up for up to another nine months under the government’s calculations.

While the government inflation rate moves toward the Fed’s 2% goal at a snail’s pace, higher interest rates are likely to mean lower valuations for bonds as well as stocks. Higher rates will also stem borrowing for business expansion and mortgages which in turn could cause home prices to fall. Let’s see how long it will take for lower home prices to show up in the media and the living room conversations.